Some Ideas on Car Insurance For A 16 Year Old - Mycarinsurance123 You Should Know

The most effective method to reduce your young adult's vehicle insurance policy rate is to add them to your existing insurance coverage plan if they currently have their very own and after that search for discounts to further lower the expense. Various other noteworthy methods to lower the cost of adolescent auto insurance policy consist of decreasing your teenager's coverage and also getting multiple quotes. cars.

Reduce insurance coverage Taking into consideration exactly how costly vehicle insurance is for young vehicle drivers, your teenager can conserve on their premium by limiting the quantity of insurance coverage they consist of on their plan.

Get multiple quotes The very best way to lower teenager vehicle insurance coverage is to look around for quotes from a minimum of three various companies, specifically if your young adult is obtaining their very own plan (trucks). Every insurance company utilizes their own techniques to calculate premiums, so the price that you receive from one company might not be the exact same as one more.

To learn where to start, examine out Pocketbook, Hub's picks for the ideal teenager car insurance policy business. You can additionally locate more details in our guide on exactly how to reduce auto insurance policy prices - insurance affordable.

We located that the typical expense to guarantee a 16-year-old is $813 monthly for complete insurance coverage, based on our analysis of hundreds of rates across 9 states. Generally, 16-year-old young boys pay $63 more each month contrasted to women. We discovered that Erie has the most inexpensive cars and truck insurance coverage for 16-year-old motorists at $311 each month for full protection, based upon our analysis of countless prices throughout nine states.

The 15-Second Trick For How Much Does Car Insurance Cost For A 16 Year Old?

Cost of automobile insurance policy for 16-year-olds contrasted to other ages Insuring a 16-year-old chauffeur can be extremely costly (perks). The expense to guarantee a 16-year-old motorist is even more than double the ordinary price to guarantee a 25-year-old. A 16-year-old can expect their insurance price to decrease by approximately 9% when they turn 17.

This is due to the fact that young male motorists have a tendency to show compared to young women vehicle drivers, such as speeding or driving drunk. 17$768$70518$647$586 Why is auto insurance coverage so costly for 16-year-olds? Vehicle insurance policy is far more expensive for 16-year-old vehicle drivers since they are more probable to get in accidents than older chauffeurs. dui.

business insurance cheapest auto insurance trucks cars

.jpg)

insured car cheapest car insurance vehicle insurance affordable

Prices for 16-year-olds are also higher due to the fact that insurance provider do not have existing data to base their designs on. Automobile insurance prices are partially based upon your driving background, as somebody who has driven accident-free for several years will pay much less for insurance than someone who has actually triggered a number of car crashes - accident.

This causes higher expenses for every teenage chauffeur, regardless of exactly how mindful they are. The least expensive car insurer for 16-year-olds by state Geico and State Farm are regularly the most affordable insurance providers, as both firms are the most inexpensive choice in 3 states. cheaper. Below are the most inexpensive insurance provider for a 16-year-old in our nine sample states.

Some states mandate it by regulation, and several insurance provider need it also. Also if it's not required, it's a clever suggestion to guarantee everybody is covered by your vehicle insurance policy. Usually, you only require to add a teen chauffeur to a family members plan once they have their certificate. If your 16-year-old hasn't yet passed their certificate examination, they normally do not need to be listed on your plan.

An Unbiased View of Car Insurance Information For Teen Drivers - Geico

Teen vehicle drivers often have intermediate licenses, also called provisional or limited licenses, which come with restrictions that do not apply to adult motorists. auto. 16-year-old chauffeurs in Florida can not drive between 11 p. m. as well as 6 a. m. In California, 16-year-olds can't have guests under two decades old unless a motorist aged 25 or older is managing.

insured car cheaper car insurance credit score affordable

The most effective point to do is to be contributed to a family members participant's policy as opposed to buying your very own. But there are various other methods to obtain the least expensive feasible automobile insurance for a 16-year-old. Look around at several insurer Every insurance provider uses various rates, and the discrepancy is specifically high when it concerns young adults we found that opting for one insurance company over an additional can total up to countless bucks saved over the program of a year.

You need to gather quotes from several various insurance coverage companies to be certain you're paying as low as possible (cheap car insurance). Locate discount rates for 16-year-old vehicle drivers To balance out the high cost of insurance policy for 16-year-olds, numerous insurance coverage business provide a range of targeted particularly for young vehicle drivers. Here are some typical reductions to watch out for.

0 or better), you can see a decrease in rates.: Numerous insurer will certainly offer you with a telematics driving tracker, which reduces your rates after you have actually demonstrated that you drive safely. For example, it might show that you do not unexpectedly start or stop, or swerve when driving.

: Sixteen-year-old chauffeurs are likely to have just recently taken chauffeur's education and learning, however many states allow you to take a driver's education and learning training course to automatically minimize your vehicle insurance policy rates in New york city state, the price cut is 10%.: This discount rate applies extra typically to university trainees than 16-year-old high schoolers, however if you're more than 100 miles far from residence for institution (such as boarding school), and you do not have a car with you, you'll generally certify to have your insurance policy prices lowered.

The Facts About How To Save Money On Teen Car Insurance - Ramsey Solutions Revealed

Get a cars and truck that's less costly to insure If you or your parents are purchasing a new or used cars and truck for you to drive when you transform 16, one significant factor to consider is just how much it costs to insure. The cost of vehicle insurance policy differs dramatically by auto version as an example, we located in our research of that a Honda CR-V, the cars and truck with the most affordable month-to-month prices, is 33% more affordable to insure than a Ford Mustang.

Plus, if you do obtain in a mishap, a cars will certainly be a lot more costly to repair. cheaper car insurance. Go down extensive as well as accident coverage One of the simplest methods for teens to decrease their insurance bills is to minimize the amount of protection they're paying for. The most typically gotten rid of portions of car insurance coverage are, which pay for the repair work of your own vehicle.

Both protections are optional unless you have an auto loan or lease. Dropping extensive and also collision protection is typically a far better idea when your cars and truck is older as well as not worth as much cash.

How to get auto insurance for a 16-year-old For 16-year-olds that are simply including themselves to their parents' policy, supporting the wheel can be as easy as calling your insurance policy representative or mosting likely to your insurance company's web site. Including a 16-year-old to an automobile insurance coverage plan is a perfect time to inspect with various other insurance providers to see exactly how much they charge for their protection as well as to think about changing insurance coverage companies in order to conserve cash.

cars car cheaper car car insurance

Along with it being much more pricey, there will likely be an added action in the process. They'll most likely need to have a moms and dad authorize or guarantee the arrangement, as minors can not sign legitimately binding contracts. Approach Our research utilized cars and truck insurance prices estimate from thousands of postal code across nine of one of the most populated states in the united state

All About How To Add A Teen Driver To Your Car Insurance - Reviews.com

The rates utilized were sourced openly from insurance provider filings. The prices pointed out in this research ought to be used for comparative functions only, as your own quotes may be different. Source (cars).

Insuring a 16-year-old chauffeur can be expensive. Considering that teen chauffeurs don't have the advantage of experience for insurance provider to think about when setting rates, they are thought about riskier to insure. There are methods you can utilize to conserve money and also obtain the very best car insurance policy for a 16-year-old motorist.

There is one area where parents can score significant cost savings: Picking to add a 16-year-old to a family members plan, which is generally more affordable, as opposed to having the teenager obtain a private policy. Insuring a 16-year-old on a specific plan comes with an average enhanced cost of $1,947 annually.

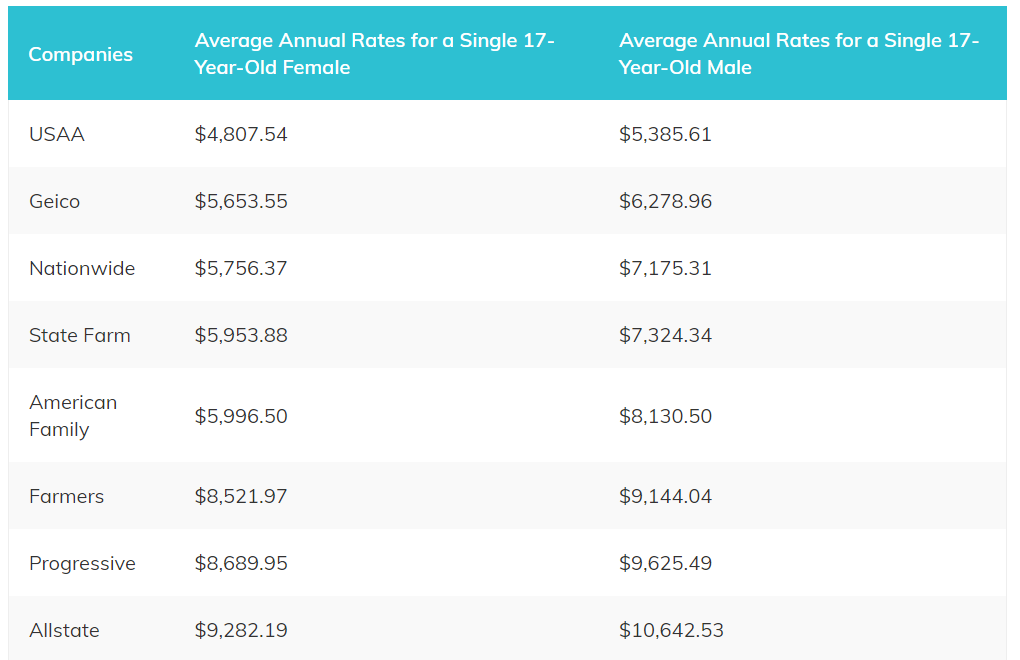

Cheapest Cars And Truck Insurance for 16-Year-Old Males as well as Females, There is a difference when it involves gender for insuring brand-new teen vehicle drivers (car insurance). Normally, it sets you back more to insure a 16-year-old male chauffeur than a women driver of the exact same age. That's because male vehicle drivers have a greater accident price and more insurance policy cases and also are consequently even more of a threat to insurance policy business.

How Best Cheap Car Insurance For Teens Of June 2022 - Forbes can Save You Time, Stress, and Money.

Scroll for a lot more Contrast Insurance Policy Prices, Guarantee you are getting the very best rate for your insurance. Contrast quotes from the leading insurer. While the least expensive average expense we found for adding a 16-year-old to a family plan is $3,146, it sets you back approximately $5,318 for a specific plan for the same-age driver.

Scroll for more Car Choice Matters When Insuring a Young Vehicle driver, The kind of car a teen motorist utilizes is one more significant consider just how much it will cost to add the teen to your policy. Expensive and also high-performance automobiles, as an example, will increase rates. business insurance. On the various other hand, a cheaper, more secure automobile can be an effective expense cutter.

Contrast Quotes for the Best Policy for Your Family Members, Display Your Teen Driver to Guarantee a Tidy Driving Document, Similar to motorists of any type of age, guaranteeing your young motorist maintains a clean driving document is an excellent way to keep car insurance coverage costs down. Conversely, crashes as well as tickets will drastically enhance car insurance coverage expenses for your 16-year-old.

Reduced the Coverage Amount, The quantity of coverage you need will vary, however, for those that are eager, lowering those can decrease the price of insurer. You'll still need to follow your state's minimum needs, certainly, yet decreasing the insurance coverages can be a legit choice for those aiming to save.

It's likewise essential to be mindful that by going with this sort of insurance coverage, you won't be covered for your own car damages or injury costs. In case of an accident, that might develop into a pricey issue if you don't have cash money on hand to replace or fix a wrecked auto.

Some Ideas on Finding The Cheapest Car Insurance For Teens - Usnews.com You Need To Know

As an example, something like a Camry a four-door car that made the top-safety pick from the Insurance Coverage Institute for Highway Safety and security will be a more affordable option to guarantee than a muscle vehicle that concentrates on efficiency, like a Mustang. Sports vehicles and also costly luxury cars, in basic, will certainly be extra pricey, as well.

Web Traffic Data for 16-Year-Old Drivers, The younger the vehicle driver, the more probable it is that they'll be associated with a collision. According to data for police-reported accidents in 2014 to 2015, chauffeurs aged 1617 were associated with practically double the variety of deadly collisions than 18- as well as 19-year-olds for every single 100 million miles driven. money.

Restricting the variety of miles your teens drive might both aid reduce expenses and also maintain them risk-free. States With the Highest Cars And Truck Insurance Expense for a 16-Year-Old, Where you live will likewise affect your automobile insurance coverage prices, not only due to the fact that the local stats can impact cost, however also due to the fact that you may have more minimal alternatives. insurers.

Review Much More on Vehicle Insurance, Vehicle Insurance Policy, Car Insurance, Regarding the Writer (accident).

Guaranteeing an adolescent motorist might offer you sticker shock when you see the premiums you have to pay. While no one wants to pay high insurance coverage costs, insurance coverage carriers have plenty of data to back up the prices they bill 16-year-olds.

The 3-Minute Rule for Teen Driving - Mercury Insurance

https://www.youtube.com/embed/WUuBrcVpSqs

Thankfully, you can do a couple of things to help lower your insurance expenses for your young adults - insurance companies. In this article Which elements influence the expense of automobile insurance coverage for teenagers? Similar to any kind of type of insurance policy, vehicle insurance providers base costs on the threats they deal with for insuring a motorist. Newly accredited vehicle drivers normally present even more threat to insurance provider than a person that has actually been driving for years.